Understanding the business cycle is crucial not just for economists, but for business professionals, investors, and even employees. Whether you’re evaluating market conditions, planning your career, or making investment decisions, the business cycle plays a significant role in shaping the economic landscape—and your place in it.

This blog breaks down the business cycle, explaining its phases, why it happens, and how it impacts businesses and individuals. By the end, you’ll better understand this economic phenomenon and its role in guiding smart decision-making.

What Is the Business Cycle?

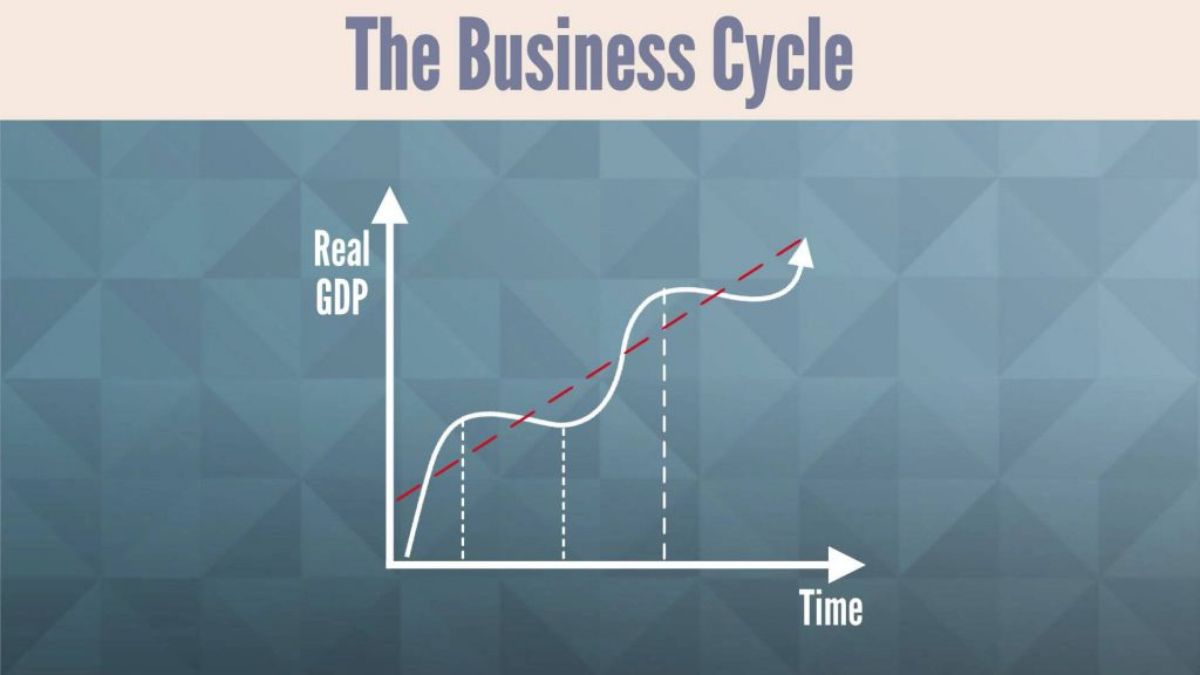

The business cycle refers to the natural ups and downs in economic activity over time. It includes periods of growth (expansion) and contraction (recession) that affect national output, employment, consumer behavior, and even government policies. While the specifics may vary, the fundamental pattern is universal across all economies.

Think of it as the rhythm of the economy—where periods of “boom” and “bust” alternate, driven by various internal and external forces like consumer demand, interest rates, technological advancements, and global events.

Key Components of the Business Cycle:

- Economic Output (GDP): Gross Domestic Product (GDP) measures the total value of goods and services in an economy. It’s one of the most common indicators used to track the business cycle.

- Employment Rates: High employment typically signals growth, while a rise in unemployment often indicates economic contraction.

- Consumer Spending: Consumers tend to spend more during periods of economic growth and tighten their budgets during downturns.

- Government Policies: Central banks and governments often intervene in response to different phases of the business cycle to stabilize the economy.

Now that we’ve defined the basics, let’s explore the phases of the cycle in detail.

The Four Phases of the Business Cycle

Every business cycle has four primary phases, each with unique characteristics and impacts on the economy:

1. Expansion

During this phase, the economy is growing steadily. Businesses are thriving, jobs are abundant, and consumer spending adds momentum to the upward trend.

Characteristics of Expansion:

- GDP increases steadily.

- Employment rates rise as businesses expand and hire more workers.

- Consumer and business confidence is high, resulting in increased spending and investment.

- Stock markets often perform well, reflecting optimism in economic growth.

Impact on Businesses and Individuals:

For businesses, expansion means opportunities to scale operations, enter new markets, and boost profitability. For employees, it often translates to higher wages and more job opportunities.

2. Peak

The peak represents the high point of economic activity in the cycle. While everything may look rosy, the economy typically begins to show signs of strain at this stage, such as inflationary pressures or overproduction.

Characteristics of a Peak:

- GDP growth slows or stabilizes.

- Markets often become overvalued.

- Inflation may spike, driven by strong consumer demand.

Impact on Businesses and Individuals:

Businesses may face rising costs, while consumers start to feel the pinch of inflation. The peak is often when central banks step in to adjust interest rates in an attempt to rein in the economy and prevent overheating.

3. Recession (or Contraction)

After the peak comes the downturn. A recession marks a period of shrinking economic activity, challenging both businesses and individuals. Technically, a recession is identified when GDP declines for two consecutive quarters.

Characteristics of Recession:

- GDP contracts, reflecting reduced economic output.

- Unemployment rises as businesses cut costs and lay off workers.

- Consumer and business confidence plummet, leading to decreased spending and investment.

Impact on Businesses and Individuals:

Businesses face declining sales and profitability, often prompting cost-cutting measures like layoffs. Individuals may face job losses or reduced income, and consumer spending weakens overall.

4. Trough

The trough is the low point of the cycle, marking the end of a recession and the beginning of a recovery. It’s the turning point where the economy starts to stabilize and prepare for a return to growth.

Characteristics of the Trough:

- GDP is at its lowest point but stops declining.

- Employment begins to stabilize as businesses find footing.

- Consumer behavior shows early signs of recovery.

Impact on Businesses and Individuals:

For businesses, the trough offers a chance to reset and prepare for the coming expansion phase. For individuals, optimism gradually returns as job opportunities increase.

Why Does the Business Cycle Happen?

The business cycle is influenced by a combination of factors—some internal to the economy itself and others external. Here are some key drivers:

- Consumer Behavior: Increased spending drives growth, while reduced spending leads to contraction.

- Monetary Policy: Central banks, such as the Federal Reserve, influence the cycle by adjusting interest rates and controlling money supply.

- Technological Innovation: The adoption of new technologies often spurs growth by increasing productivity and opening new markets.

- Global Events: Events like wars, pandemics, or natural disasters can shock the economy, influencing the timing and intensity of cycles.

- Market Dynamics: Imbalances in supply and demand, market speculation, and even psychological factors can all influence the cycle.

The interplay of these factors creates the rhythm of expansion and contraction that defines the business cycle.

How the Business Cycle Impacts You

Whether you’re a CEO, an employee, or an investor, the business cycle affects nearly every aspect of financial and professional life. Here’s how:

For Businesses:

- During Expansion: Businesses may invest in growth, hire more employees, and launch new products or services.

- During Recession: Companies often focus on cost-cutting, efficiency, and survival strategies.

For Individuals:

- During Expansion: Employees benefit from greater job security, raises, and opportunities for career advancement. Consumers feel more confident spending on bigger purchases.

- During Recession: Cutting back on spending becomes a priority, and savings are often redirected toward essentials.

For Investors:

Understanding where we are in the business informs strategic investment choices. For example, growth stocks may perform best during expansion phases, while safe-haven assets like bonds thrive in a recession.

Making the Business Cycle Work For You

With knowledge of the business cycle, you can make more informed choices in every area of your life. Here are a few actionable tips:

- Stay Proactive: Anticipate downturns by building an emergency fund or streamlining operations in advance.

- Be Opportunistic: Expansion periods are excellent for investments, career moves, and long-term planning.

- Diversify Risks: Spread your investments or income sources to safeguard yourself through economic fluctuations.

By remaining tuned into key economic indicators and trends, both individuals and businesses can turn the business into a tool rather than a challenge.

FAQs

Q: What is the business cycle?

A: The business cycle refers to the natural fluctuations in economic activity over time, including periods of expansion, peak, contraction, and recovery.

Q: How does the business cycle impact individuals?

A: The business cycle can influence job opportunities, wages, and the cost of goods and services. During expansions, people may find better employment opportunities, while recessions can lead to financial challenges.

Q: How can businesses prepare for changes in the business cycle?

A: Businesses can prepare by diversifying income streams, monitoring economic trends, and maintaining financial reserves to weather downturns.

Q: What are some key indicators of the business cycle?

A: Common indicators include GDP growth, unemployment rates, consumer spending, and inflation levels. Following these metrics can help predict economic shifts.

Q: Can individuals influence the business cycle?

A: While individuals cannot directly control the business cycle, collective spending, saving, and investment habits can contribute to overall economic trends.